Options portfolio optimization of exotic options written on Mini S&P500 Index in an illiquid market with Conditional Value-at-Risk (CVaR)

Benyanee Kosapong, Petarpa Boonserm, Udomsak Rakwongwan

Keywords:

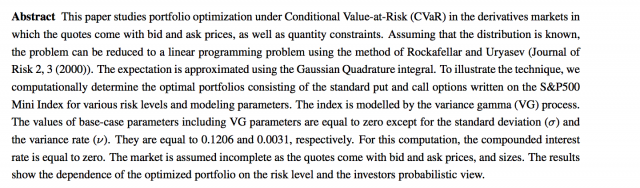

Portfolio optimization, Conditional Value-at-Risk (CVaR), Derivatives markets, Gaussian Quadrature, Variance Gamma processAbstract

Downloads

Published

2022-03-31

How to Cite

Team, S. (2022). Options portfolio optimization of exotic options written on Mini S&P500 Index in an illiquid market with Conditional Value-at-Risk (CVaR): Benyanee Kosapong, Petarpa Boonserm, Udomsak Rakwongwan. Thai Journal of Mathematics, 169–183. Retrieved from https://thaijmath2.in.cmu.ac.th/index.php/thaijmath/article/view/1298